8 NFT Rug Red Flags and How to Be Careful

1. Anon Team

In our original NFT Bill of Rights we warned about anonymous artists and have extended that to include Anon or “undoxxed” teams. Sometimes a part or portion of the team may be doxxed for a myriad of reasons, but at least 50% of the team should be completely doxxed and findable on social media etc. Additionally, just because there is a picture of the person(s) on the website doesn’t mean that person exists. They can be stock photography or AI / ML generated images like these: This Person Does Not Exist You can hit refresh and see examples. You can also learn more about our stand on anonymity here.

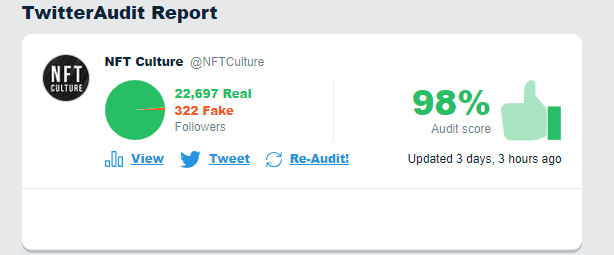

2. Fake Account and Fake Followers

Today it’s easier than ever to either buy older established twitter accounts or even buy followers. In addition to checking the twitter of the project you’re researching, also research the twitter accounts for the “team” behind the team. Currently there are a number of red flags. If the account age is too old (Older than NFTs have been popular), its likely a re-purposed account for NFTs. If the twitter account has a massive following, run it through Twitter Audit and check what % of the followers are fake.

Additionally, discord bots have become incredibly sophisticated. We have seen examples where users can setup 20 discord accounts in minutes to bot WLs. If its this easy for an individual to mass create discord accounts, discord as a service is an even bigger concern. For less than .1 ETH, a discord can import thousands upon thousands of discord users all running via simple scripts to make the engagement look real. (Looping WGMI, GM, Etc.).

3. Expensive (or Free) Mint Price

We’re seeing more and more projects launching with a premium price tag for the NFT. The current hypecycle is discouraging price discovery and allowing creators to claim more of the original mint price than they used to. This is fine for certain projects, but always proceed with caution. If it doesn’t feel right, it’s not worth over extending to chase a project. Especially if any of the other boxes are checked indicating that this is a risky project.

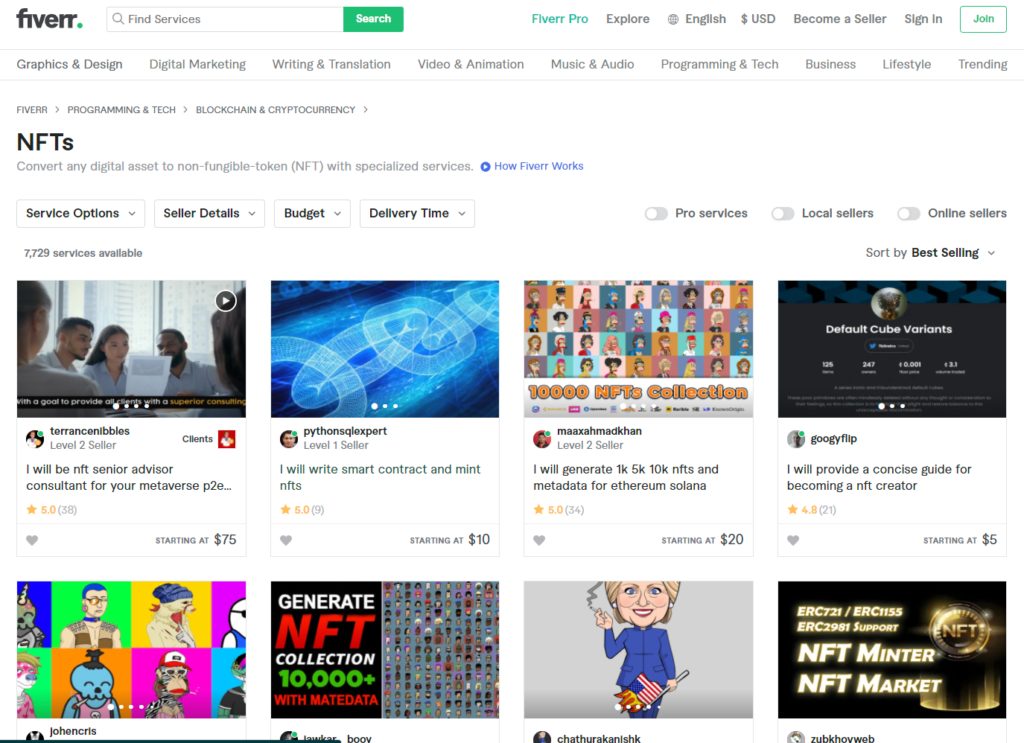

Additionally, free mints are becoming less and less of a successful tactic for projects. Some scammers have found that they can put a little effort into a semi-polished website and release it for free. If the project gains any momentum or excitement, the project can generate 100-500 ETH in volume and if the project takes 10% can generation between 25k and 150k with very little effort. (a couple hundred dollars on fiver and deploying the smart contract.)

4. Limited Art

If the artist isn’t extremely well established (and has a portfolio you can review) check for a wide array of art, traits, etc. It’s easy to pay a fiver artist to come up with a few concepts that look like they have wildly differing variety and rarity. Looking at a consistent art profile and portfolio is important. Also, if you don’t love the art or it doesn’t resonate with you, it’s worth passing as well.

5. Copy Pasta Website

Continuing the themes of high risk projects is the design and incorporation of the website. After an early version of the banana repo was found on github that had an entire NFT project deployment (soup to nuts) available for anyone to download and edit, Copy Paste projects started springing up like weeds. Today, coordinated groups will literally deploy many projects in a single day, all with slightly differing art or website customization. Keeping track of the projects that exist makes it easier to see what projects may look or be similar to eachother and help you avoid pitfalls.

Check out the daily drops in our drop calendar.

6. Lacks Innovation

The final area of concern as it relates to project is around the roadmap. Is the project under / over promising on the roadmap? Both of those can be massive red flags for a project. The two big red-flags here are 1. does the project essentially have no roadmap available? It likely won’t have additional utility after launch. Additionally, if the project is over promising (AAA games, Play to Earn, advanced tokenomics / staking capabilities) you should be wary as well. Additionally, you should have a basic understanding of your countries laws and regulations around securities (because it could become a long term rug).

7. Toxicity

It’s not common knowledge but it’s a violation of OpenSea ToS for project creators to sweep their floors. Projects can lose their blue checkmark etc, if they do that. Additionally, if projects (including moderators) are super controlling of valid critique around projects, it’s a sign that something else may be going on behind the scenes.

8. Derivatives

99/100 times a derivative is a rug. There are outliers, but they aren’t common. With the blockchain, it’s incredibly easy to copy metadata, art, etc. and make basic changes. There are examples of derivatives that take an idea and blend it with something else to become something truly unique (and a new creation on its own). But if you’re unsure, it is worth skipping the project all together.

Conclusion

Most projects (even if they aren’t meant to be a rug) are designed to remove you from your ETH. Approach every project as a skeptic. Do research, examine the teams, roadmap and more. If you miss a project, there will be another 35-50 tomorrow. Do your own research and come up with a strategy that works for you. More importantly, Scammers have a talent at looking at the latest trends and techniques combining them with their ability to exploit human nature to take advantage of their prey (agnostic of medium.)

Some Final Tips to Help You Stay Safer

- Find your tribe: Find a discord community with a proven track record of vetting projects and open communication / dialogue about pros and cons of a project

- DYOR: cross reference artists, websites, mint pages, etc. 5 minutes of research can save you thousands of dollars of potentially lost ETH if you mistakenly mint a rug project.

- When in doubt, pass on the project

- NEVER GOOGLE THE PROJECT (but if you do, validate both the discord and twitter for accurate mint page).

- DONT SIGN ANYTHING THAT YOU OPENED FROM AN EMAIL. (in fact, you should have your email in a different browser than your wallet).

What tips do you have? let us know in our discord or on twitter.